Core Concepts

The Agent Payments Protocol (AP2) is built on a foundation of core principles and a role-based architecture designed to create a secure, interoperable, and fair ecosystem.

Guiding Principles

- Openness and Interoperability: AP2 is an open, non-proprietary extension for agent-to-agent protocols, fostering a competitive environment where any compliant agent can work with any compliant merchant.

- User Control and Privacy: The user is always the ultimate authority. The protocol is designed with privacy at its core, using a role-based architecture and encryption to protect sensitive user data and payment details.

- Verifiable Intent, Not Inferred Action: Trust is anchored to deterministic, non-repudiable proof of intent from the user, directly addressing the risk of agent error or "hallucination."

- Clear Transaction Accountability: For the payments ecosystem to embrace agentic payments, there can be no ambiguity regarding transaction accountability. The protocol provides supporting evidence that helps payment networks establish clear and fair principles for accountability and dispute resolution. By creating a non-repudiable, cryptographic audit trail for every transaction, the framework provides the evidence necessary to resolve disputes confidently.

A Role-Based Architecture

The protocol defines a clear separation of concerns by assigning distinct roles to each actor in the ecosystem:

- The User: The individual who delegates a payments task to an agent.

- User Agent (UA) / Shopping Agent (SA): The AI surface the user interacts with (e.g., Gemini, ChatGPT). It understands the user's needs, builds a cart, and obtains the user's authorization.

- Credentials Provider (CP): A specialized entity (e.g., a digital wallet) that securely manages the user's payment credentials and methods.

- Merchant Endpoint (ME): An interface or agent operating on behalf of the merchant to showcase products and negotiate a cart.

- Merchant Payment Processor (MPP): The entity that constructs the final transaction authorization message for the payment network.

- Network and Issuer: The payment network and the financial institution that issued the user's payment credentials.

Trust Anchors: Verifiable Credentials (VCs)

The central innovation of AP2 is the use of Verifiable Credentials (VCs) to engineer trust. VCs are tamper-evident, portable, and cryptographically signed digital objects that serve as the building blocks of a transaction. They are the language of trust exchanged between agents.

There are three primary types of VCs:

1. The Cart Mandate (Human Present)

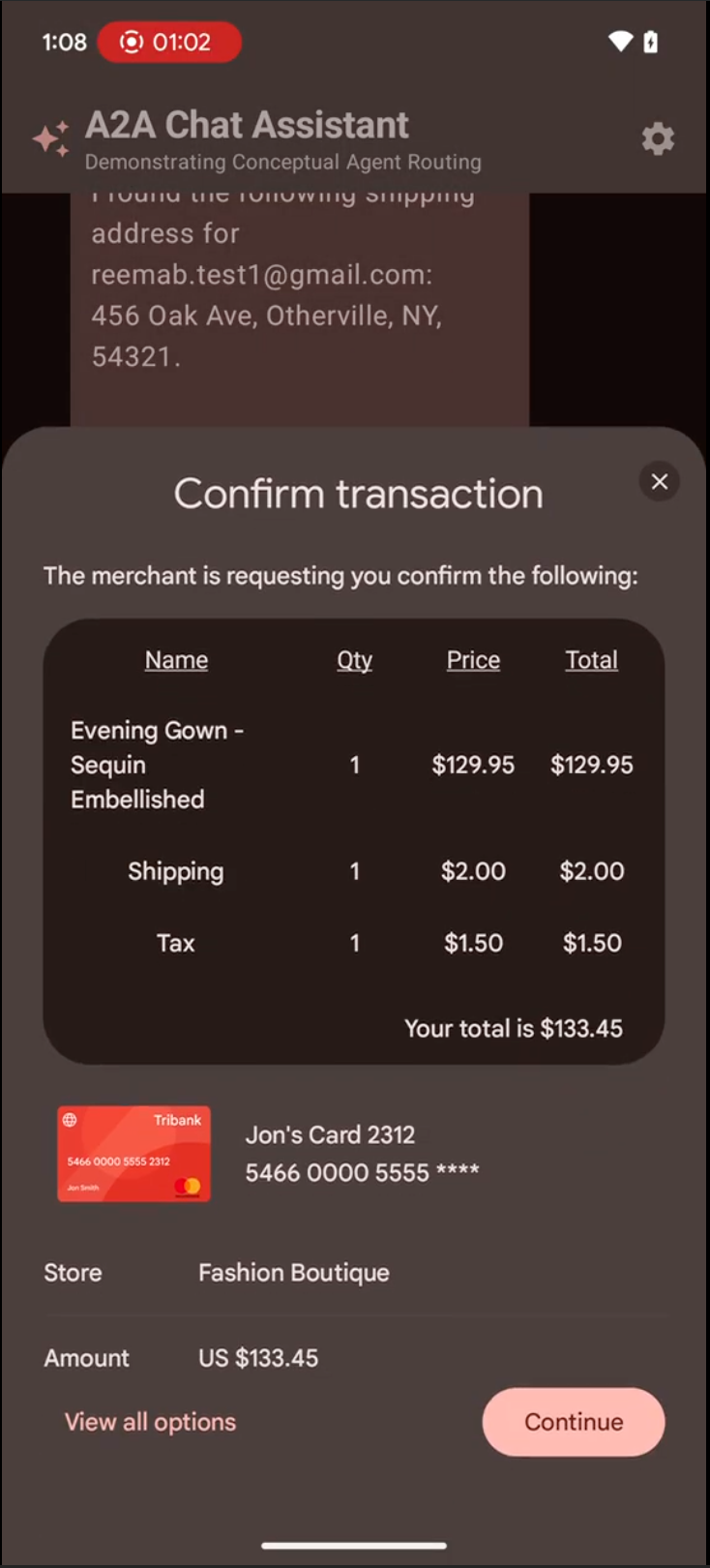

The Cart Mandate is the foundational credential used when the user is present to authorize a purchase. It is generated by the Merchant and cryptographically signed by the user (typically via their device), binding their identity and authorization to a specific transaction.

A Cart Mandate contains:

- Verifiable identities for the payer and payee.

- A tokenized representation of the specific payment method.

- The final, exact transaction details (products, destination, amount, currency).

- A container for risk-related signals.

2. The User-Signed Intent Mandate (Human Not Present)

The User-Signed Intent Mandate is used for scenarios where the user is not present at the time of the transaction (e.g., "buy these tickets when they go on sale"). It is generated by the Shopping Agent and signed by the user, granting the agent authority to act within defined constraints.

A User-Signed Intent Mandate contains:

- Verifiable identities for the payer and payee.

- A list or category of authorized payment methods.

- The shopping intent, including parameters like product categories, and other criteria.

- The agent's natural language understanding of the user's prompt.

- An expiration time (Time-to-Live).

3. The Payment Mandate

This is a separate VC shared with the payment network and issuer. Its purpose is to provide visibility into the agentic nature of the transaction, helping the network and issuer build trust and assess risk. It contains signals for AI agent presence and the transaction modality (Human Present vs. Not Present).